The Tax Slips page enables you to view tax slips for either a single payroll year or all payroll years. The following table lists all the ways to view tax slips.

Filter |

Description |

|---|---|

Payroll Year |

Allows you to filter slips by year with the following options available:

|

Show latest revision only |

If the check box is selected the tax slips displayed will be the current revision. If its not selected, all revisions will be displayed. |

View link |

Click this link to open the selected PDF file. |

Download link |

Click this link to save the selected PDF file to your computer. |

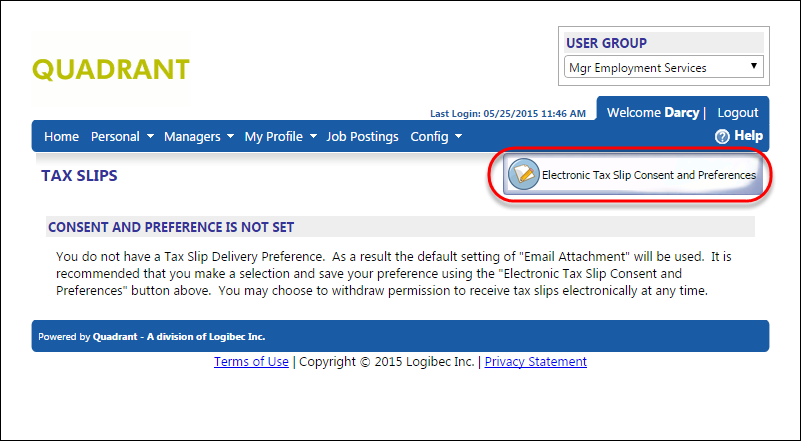

You can specify the way you want to receive your tax slips from your company. If you want to receive them electronically, either through Quadrant Self Service or by email attachment, you must provide your employer with your consent. This is important to comply with legal requirements based on privacy laws. After you submit your consent it will remain valid until you withdraw your consent. You can withdraw your consent at any time, either by using the form in Quadrant Self Service, or by contacting your Payroll Department.

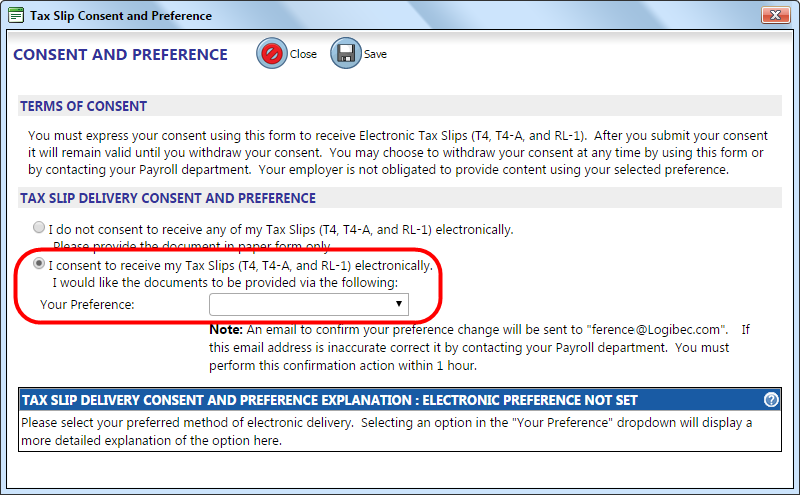

If you want to receive electronic tax slips select this option, and then choose a Preference.

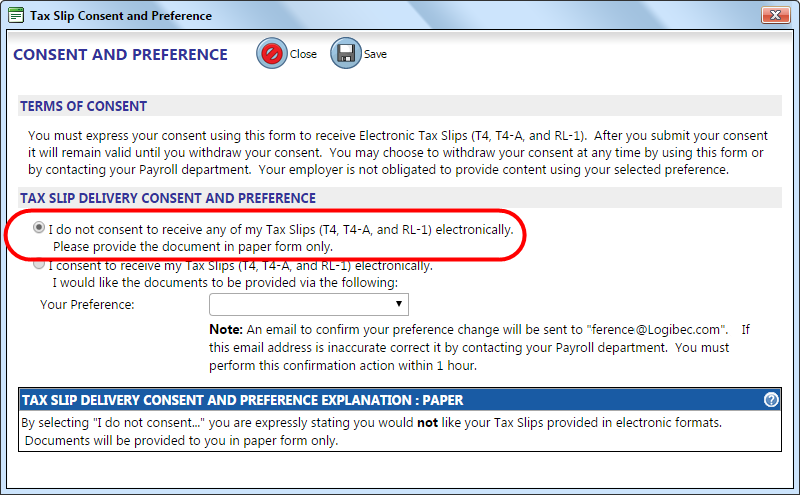

If you don't want to receive electronic tax slips select this option.